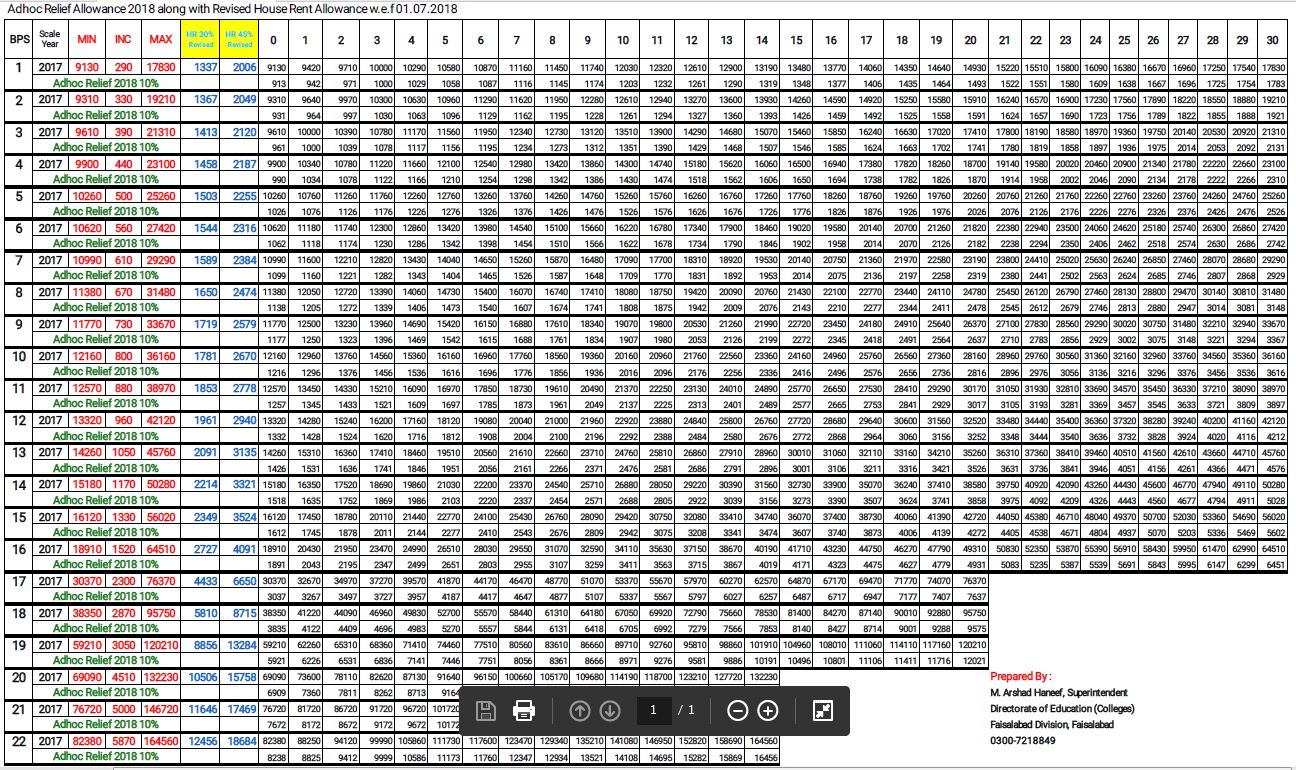

Today the Budget 2023-24 Pakistan Government Employees Salary Increase Chart with full details of Scale 01 to 22 is available here at www.finance.gov.pk and www.fbr.gov.pk where people can free download your pay scale revised pension and pay increase in Pakistan Budget 2023 to 2024 and also online check the official news by the Prime Minister Mr. Shahbaz Sharif is representing in the national assembly hall for the servants of Punjab, Sindh, Baluchistan, Gilgit Baltistan, Khyber Pakhtunkhwa (KPK), Azad Jammu and Kashmir regarding pay scale chart 2023 and revised pay scale 2023-24.

The government of Pakistan’s Ministry of Finance department deals with & pertains to the finance of the Federal Government and financial matters that affect the whole country. The Ministry of Finance is responsible for prepaid annual budget statements as assigned under the Rules of Business, 1973.

How Much Pay Increase in Budget 2023-24 Pakistan Full Chart

Federal Minister for Economic Affairs Mr. Miftah Ismail has announced Pakistan Budget 2023-24 Details Check

Suggestions for allocation to different sectors

- 7600 Billion Allocated for Budget 2023 to 2024 Pakistan

- Proposal to allocate Rs. 1 billion for WAPDA

- 25 Billion Subsidies for K Electric

- 03 Billion for Utility Stores

- 07 Billion For PESCO

- 49 Billion For all subsidies

- 69 Billion for Water Resources

- 12 Trillion 89 Billion for Defense

- 10 Billion for Agriculture

- 37 Billion for Communication and other fields

- 13 Billion for Lahore and Karachi Hospitals

- 48 Billion For KPK districts

- 650 Billion For PSDP

- 06 Billion for Ministries of Climate Change

- 800 Billion For State Bank Loans Payments

- 80 Billion For Power Transmission System

- The decrease in FBR receipts has been fixed

- The requirement for a National Identity Card has been increased from 50,000 to 100,000.

- 250 Billion For Social Sectors

- 208 Billion For Ehsas Program

- 180 Billion For Energy and Food

- 20 Billion For Science and Information Technology

- Budget deficits reached a high rate of 2300 Billion

- 10 Billion for Baluchistan Special Grant

- Excise Duty increasing 65% to 100%

- The excise tax will be levied on double-cabin pickups

- Excise duty increasing from 13 % to 25 % on all drinks

- Auto Rickshaw Motorcycle and 200 CC Motorcycles advance tax is finished

In the National Assembly, Punjab Revised Pay Scale 2023-24 has been announced by the Federal Minister to continue revenue, economic affairs, and financial affairs, Miftah Ismail It is said that it is not a mini-budget rather it is for a set of economic reforms. Federal Budget 2023-24 highlights the following steps:

- 20 % of Loans will be decreased for low-income housing.

- Rs 5 Billion would be declared for revolving funds up.

- Tax will be the same for expensive phones & low-priced phones.

- 5 % of diesel engines for agriculture motives will be decreased.

- On mobile cards, about 30 % returned.

- Tax increased on vehicles for 1800CC.

- Tax on agriculture will be diminished to 20 %.

Every country makes/prepares a budget annual basis to run the economic, social, agricultural, and all other systems of the Country. Govt. puts a suitable and appropriate national Budget 2023 for every department to continue departmental work the whole year, some departments avail less budget whole year and some utilize too many funds like the health department, emergency services, etc. Govt. allocates and applies a tax on every household uses items that are consumed by the public.

Updates Government Employees Salary Increase In Budget 2023-24

In Sindh Budget 2023-24 finance department allocated Rs.1100 billion to run the system for defense expenditures. And about 10 percent of salaries increased and pensions for civil and military employees. Budgeting is the procedure of generating or establishing a plan where to spend money on the interests and well-being of the country. This plan is called a budget. The budget will tell you to settle in advance whether you will have sufficient money to do some work.

There are a few types of budgets these names are five.

- First Master Budget 2023 in this budget is made for the company’s individuals and designed to show full & complete pictures of financial activity.

- Secondly Operating Budget.

- Third Cash Flow Budget.

- Fourth Financial Budget.

- Fifth static Budget.

The motives of Budgeting are to allocate, plan, coordinate, control & motivate to find resources.

Silent features of Baluchistan Budget 2023-24 are the Sehat ka Insaf program for FATA, increase in Federal Excise duty for luxury, withdrawal of petroleum development levy, 10 % enhancement in pensions, and no tax on income annually for Rs 12 Lac. Rs. 50 billion in Karachi through development projects. Increase tax on Tobacco products. No tax rebate on PM and Minister’s Allowances.

Development tax on Schools, Clinics, Roads, etc., Rs 50 billion would be spent on Karachi projects. On CPEC projects will continue any hurdles. Taxes on Income will be applicable from Rs 12 Lac to Rs 24 Lac is a 5 % fixed tax. Up to Rs 4, Lac is exempt. The maximum tax for a non-salaried class is 29 % and the maximum tax for a salaried class is 25 %. Rs 8 Lac to 12 Lac is Rs two thousand. Such items to become expensive are Twenty percent duty placed on 1800cc vehicles. Duties on cigarette tubes raised, Duties on 300 luxury items, containing high-end mobile phones, imported food, etc.

Budget 2023-24 Pakistan All Department Employee Salaries Increased

In Local Budget 2023-24, it is authorized that there will be a 10 percent increase in low-income pensioners which is about 85 % of total pensioners. Subsidies of the current budget are 4.5 Rs billion for the construction of 8,276 low-cost labor-class houses, For Fata, the Islamabad health card declared a subsidy of Rs 5 Lac 40 Thousand which will be applicable to per family. Approximate 100 billion to be furnished to the petroleum tax.

The total amount of Federal Budget 2023-24 put forward a payout of Rs 7148 crore for a sector of the textile as compared to Rs six thousand core in 2020. Every year budget for the welfare of the country is presented by the current Finance Minister of the country. Mr. Shaukat Tarin proposed a total expenditure for Budget 2023-24 of N8.6 trillion it increase of an estimated sixteen percent from the revised pay scale 2023-24.

The government proposed the total budget outlay for Pakistan’s military is 5.9 trillion in Pakistan rupees, 51.06 billion $.

All the updates related to the Budget 2023-24 Pakistan Government Employees Salary Increase Chart BPS 01 to 22 The full PDF file is attached here for the people who can free download on this web page. The people can see also the Pay Pension increase in Budget 2023 to 2024 Pakistan The highlights are provided the social media like Facebook, Twitter, and newspaper media news channels including SAMA, GEO, ARY, and Express where the whole date is mentioned of the Budget 2023 Pakistan.

Download Here Budget 2023-24 Pakistan Details

Bise World Bise World | Matric Inter PU AIOU NTS Results, Jobs, Prize Bonds, Latest News and Tech reviews

Bise World Bise World | Matric Inter PU AIOU NTS Results, Jobs, Prize Bonds, Latest News and Tech reviews