Full Guidance for Income Tax Returns to Make Filer in FBR

The Federal Board of Revenue is introducing a great way for becoming How to Make Filer in FBR Registration Online Income Tax Returns for Employees Salary Persons and anyone can build up their account to pay the whole last year’s Goshwara filling out the complete form.

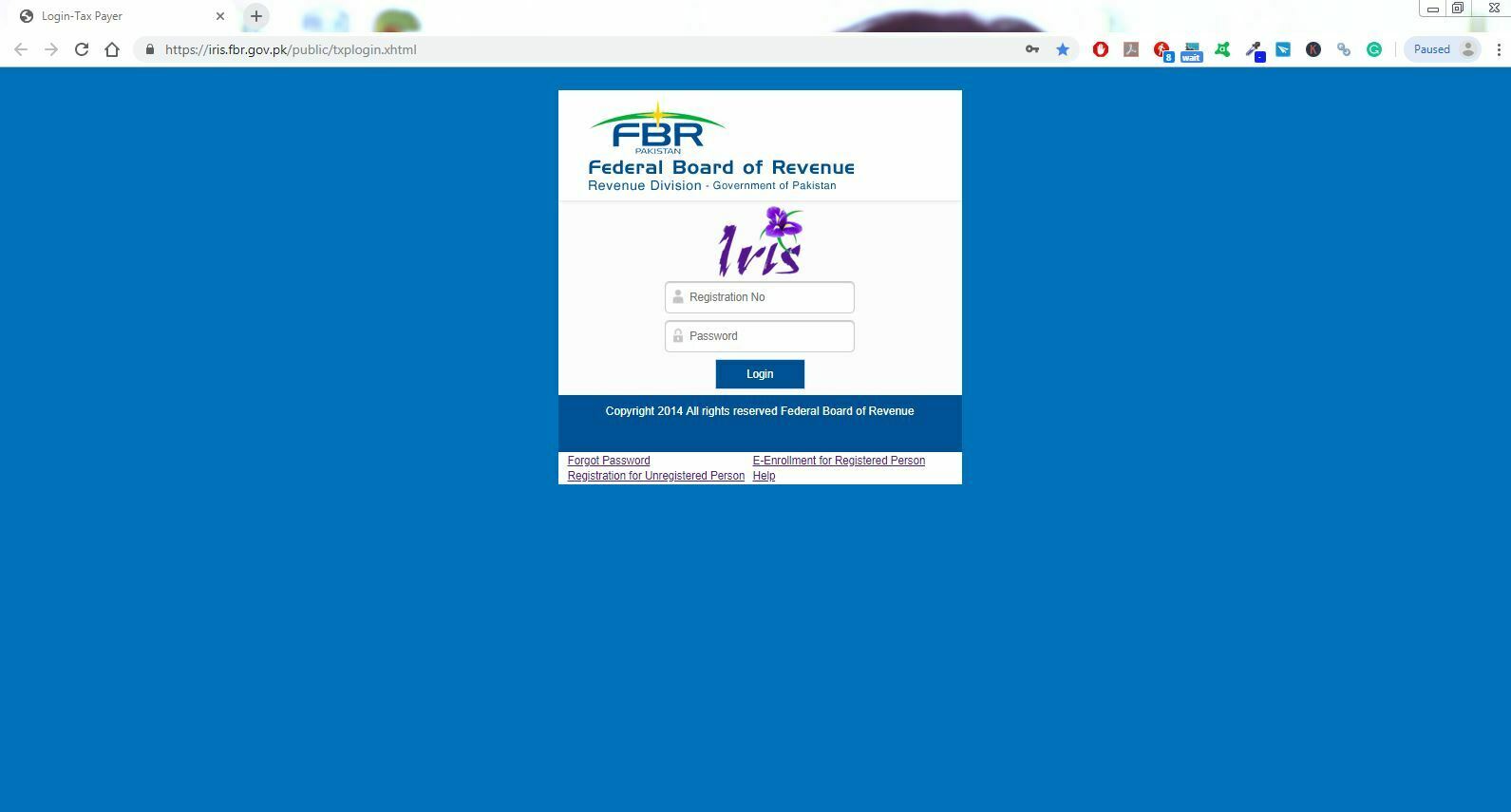

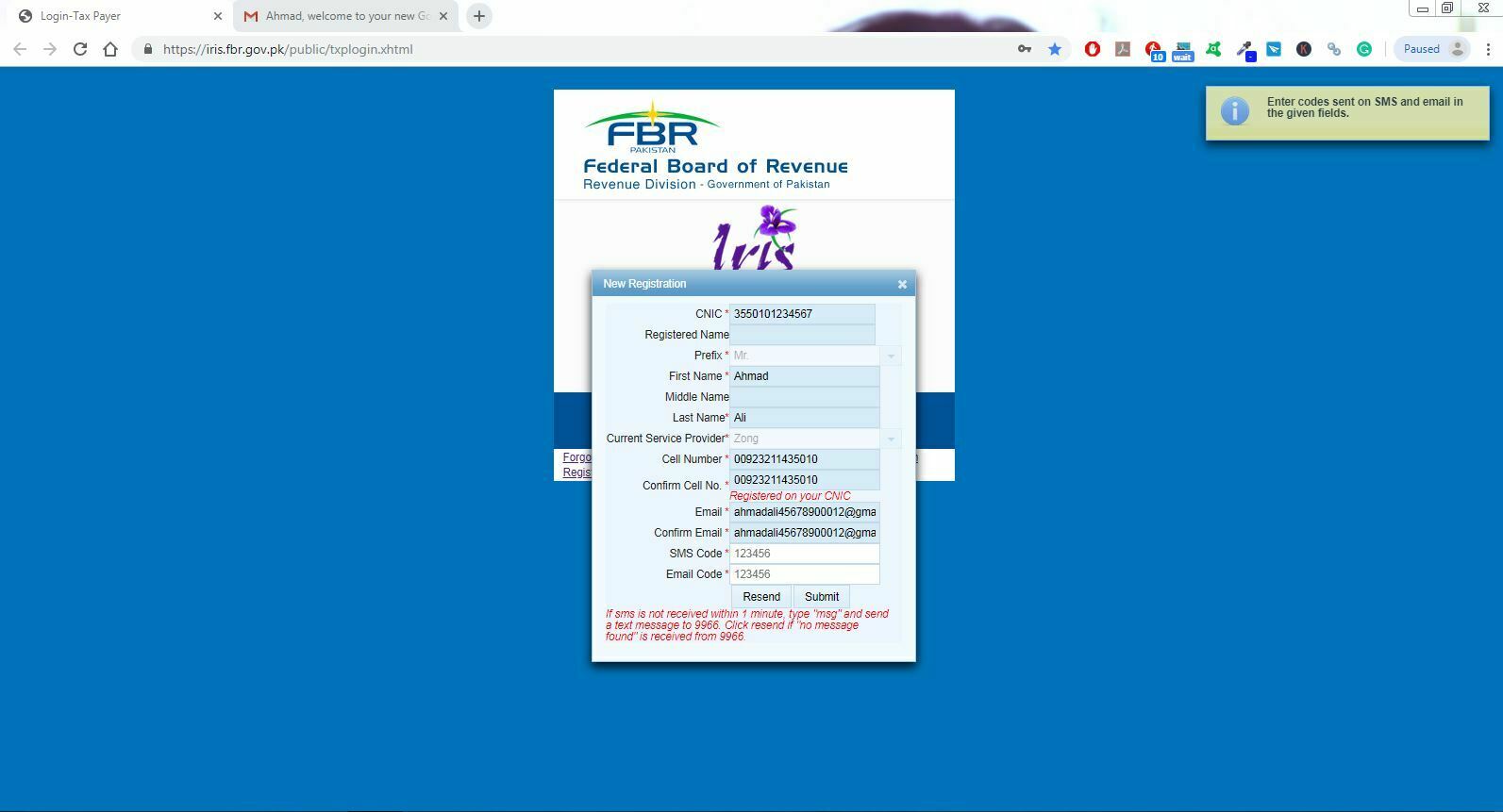

Step: 01

The Government of Pakistan is provided some easy steps to fulfill the Iris FBR Registration Form Online for becoming Income Tax Returns on this webpage at https://iris.fbr.gov.pk/public/txplogin.xhtml.

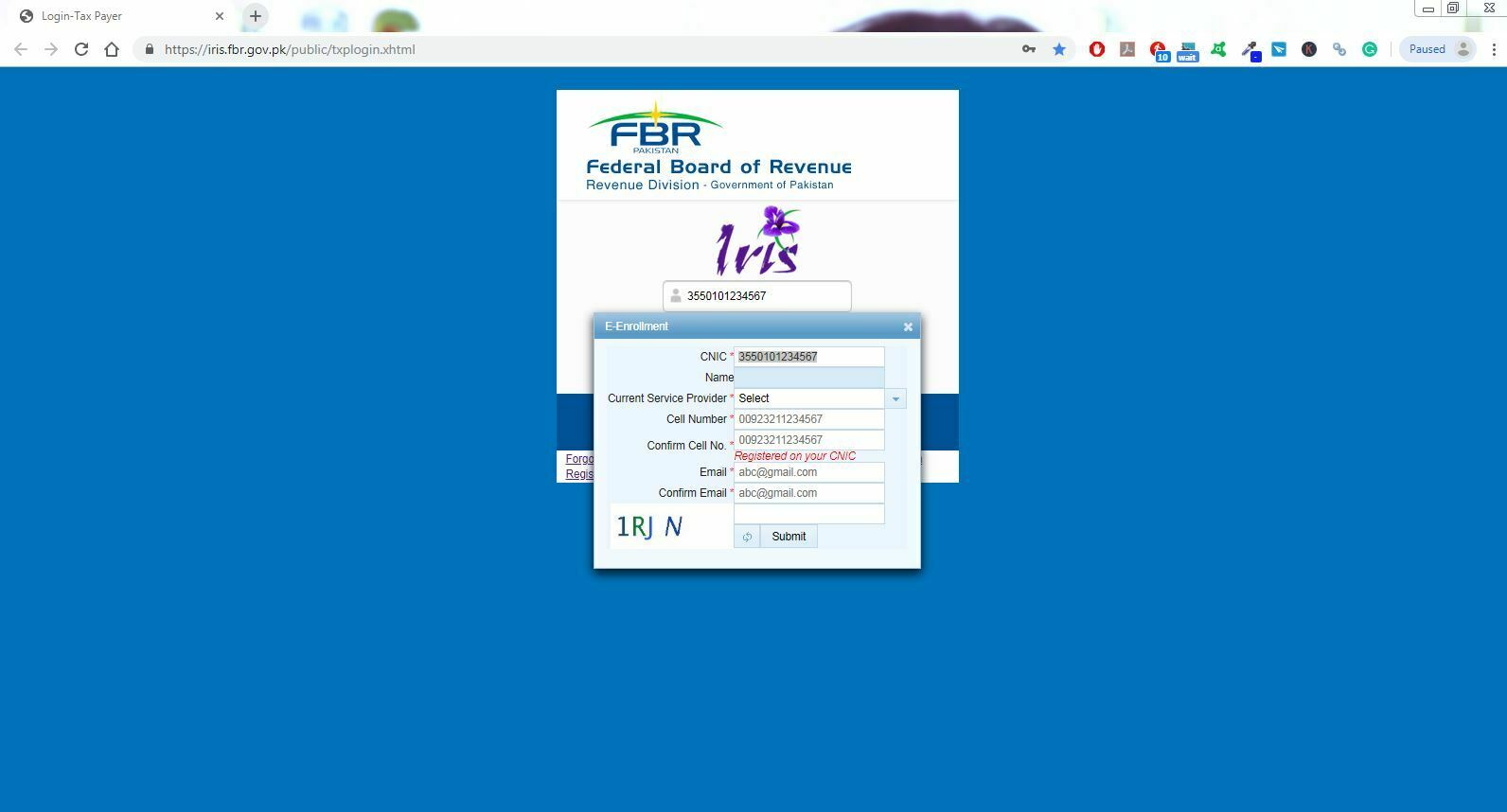

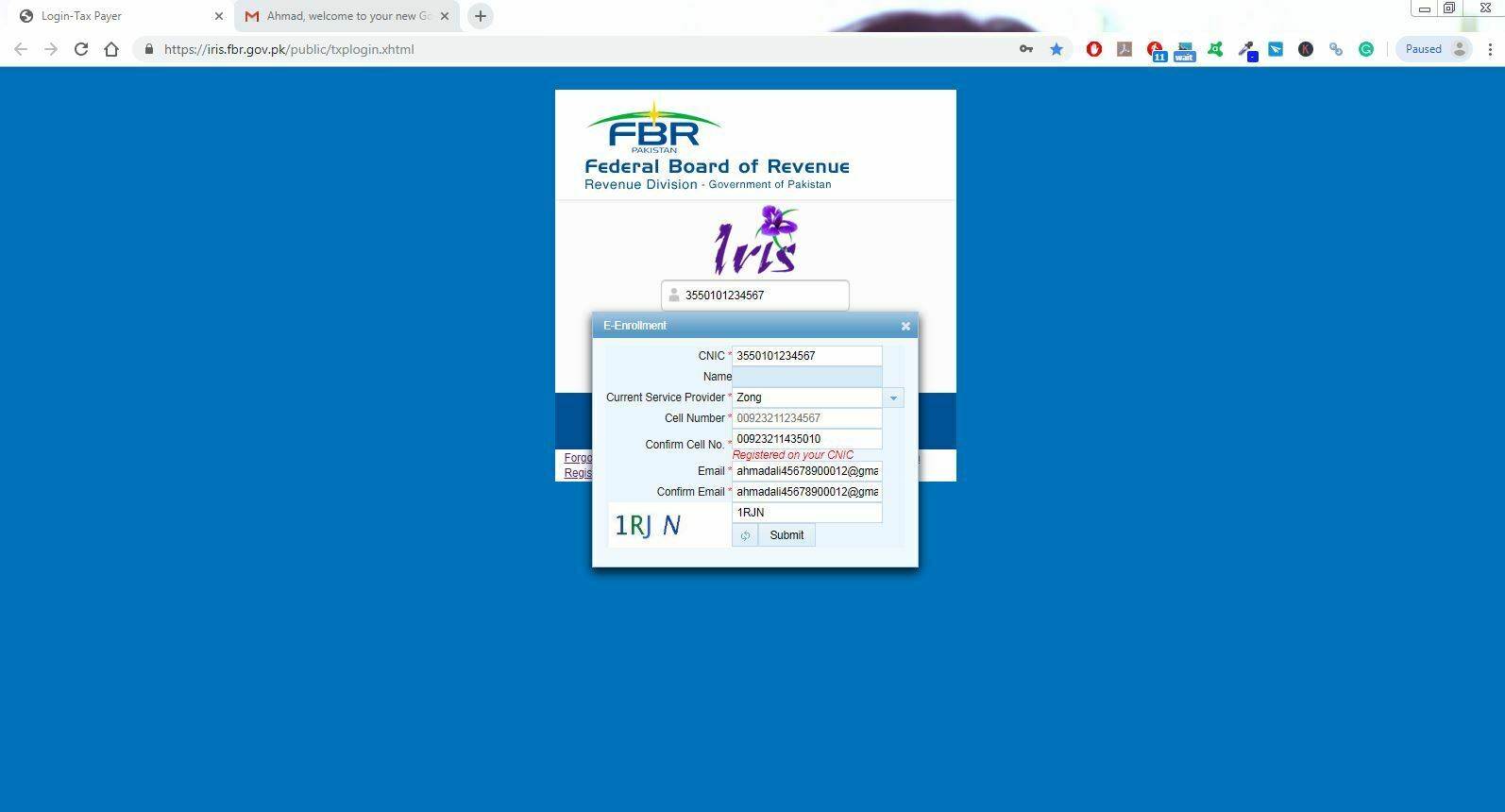

Step: 02

To obtaining the NTN Registration guided these steps to save your individual and personal bio-data information and put your details below.

Step: 03

After getting the codes through Email and Mobile phone by mail and SMS fill in the blanks then submit the next cells one by one for retrieving your account in FBR Login.

Step: 04

Select the required fields like the mobile phone network, first name, middle or last name, mobile number, email address, and code to give him for the next process. These is the easiest steps you can fill up in a few minutes.

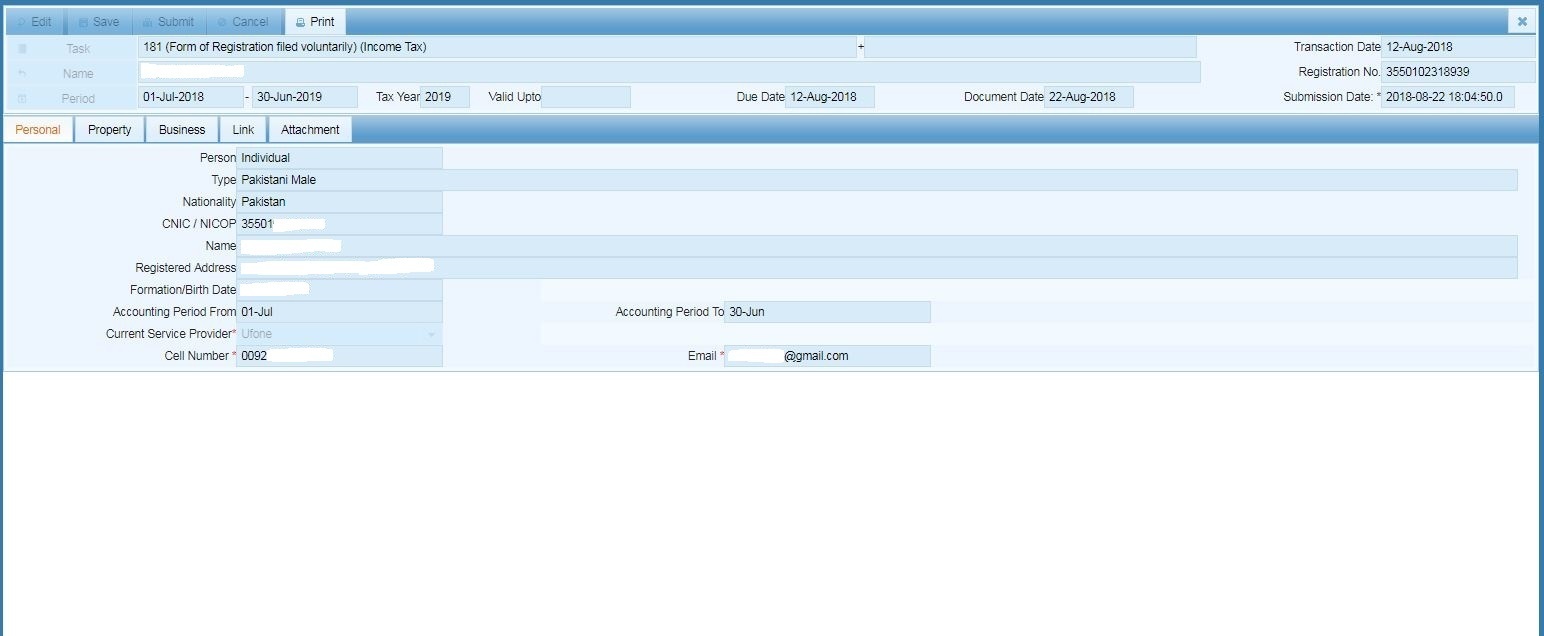

Step: 05

First, in the fall, you can fill up the 181 No. Form of Registration Field of Voluntary (Income Tax) in which various fields are filled like Personal, Property, Business, Link, and Attachment as you required and have it without facing any problem.

Step: 06

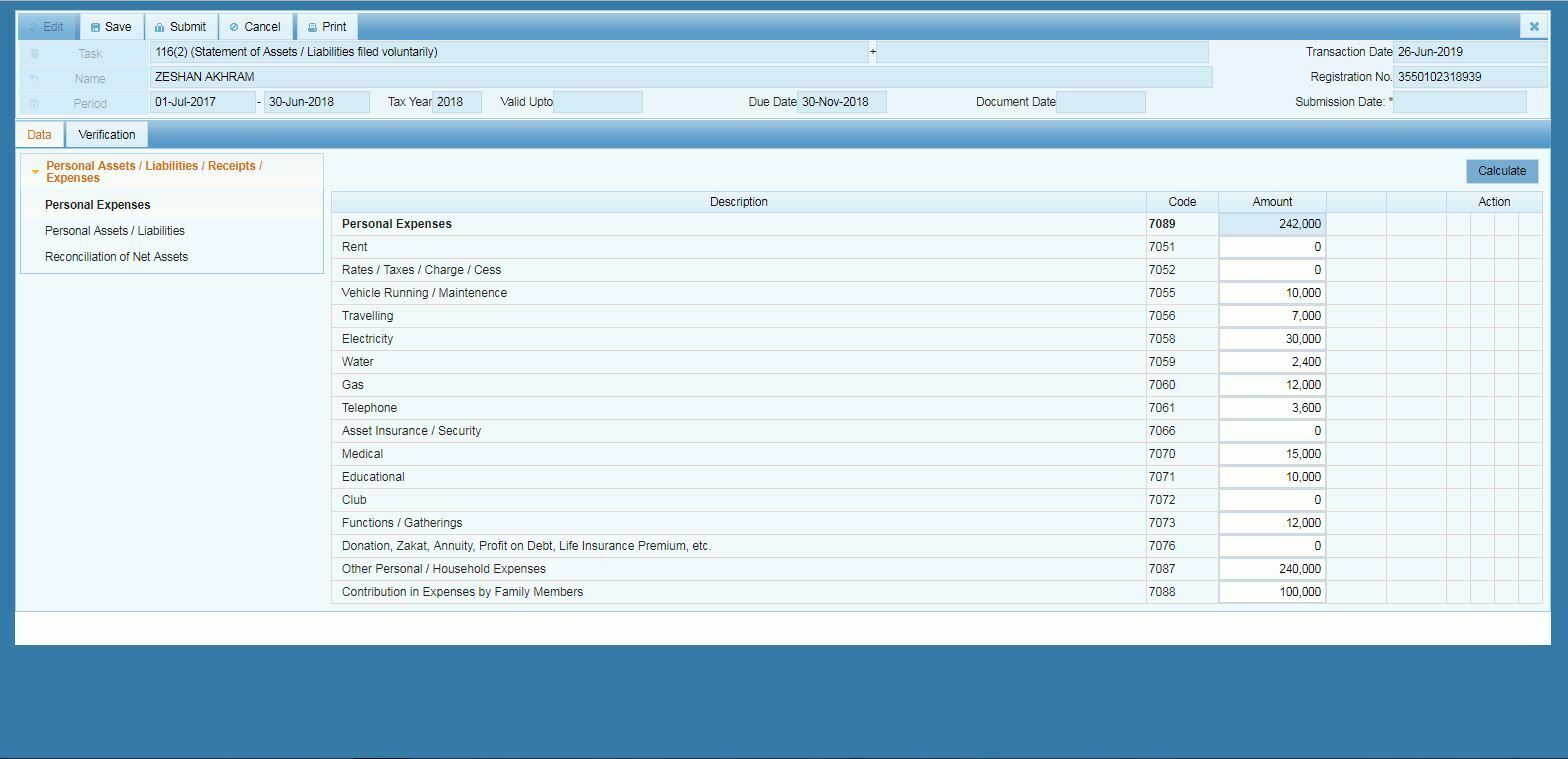

Put up the required Form 116 (2) Statement of Assets / Liabilities Field Voluntarily It is all persons compulsory are required to fill it in which some types are:

Personal Assets / Liabilities / Receipts / Expenses

First filling Personal Expenses Under the below.

Step: 07

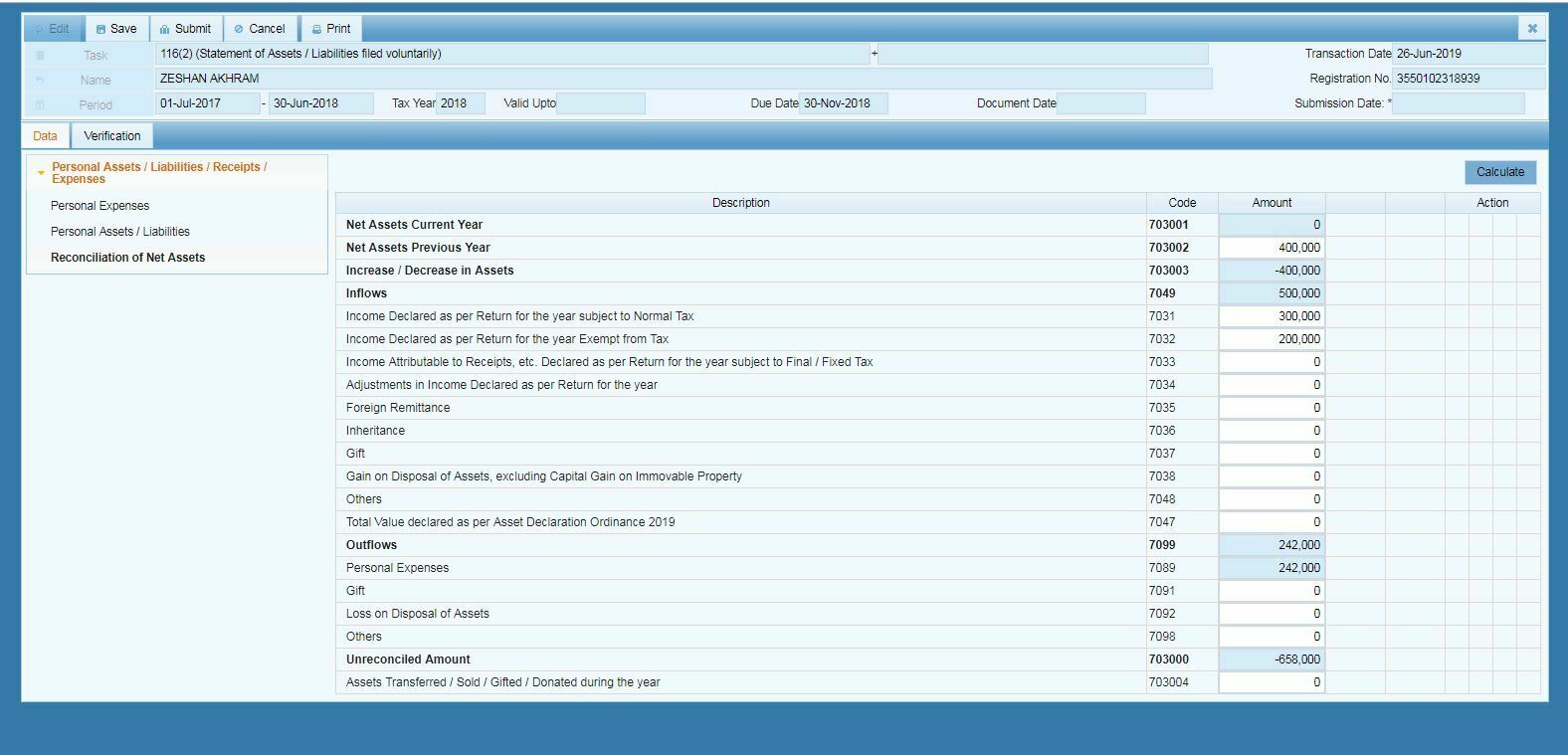

Then read the second part of the form and fill it out carefully because the whole FBR NTN Registration is depending on Form No. 116 (2).

Step: 08

In the end, you can fill up this form for putting in your personal individual Reconciliation of Net Assets for the whole year.

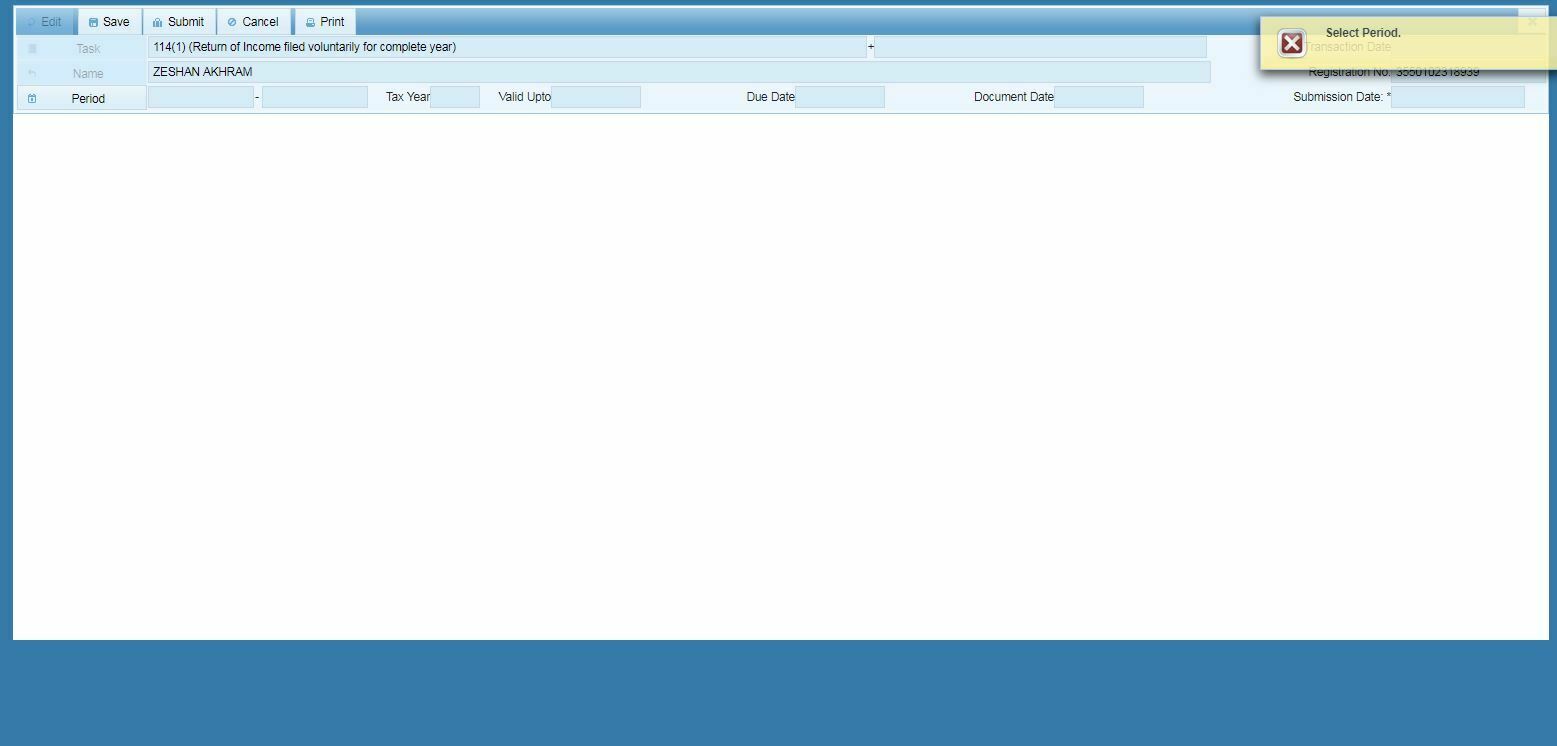

Step: 09 (2) For Shopkeepers or Common Man

To fill up Form No. 114 (1) Return of Income Field Voluntarily for Complete Year first you can select the period and then next other fields filling it.

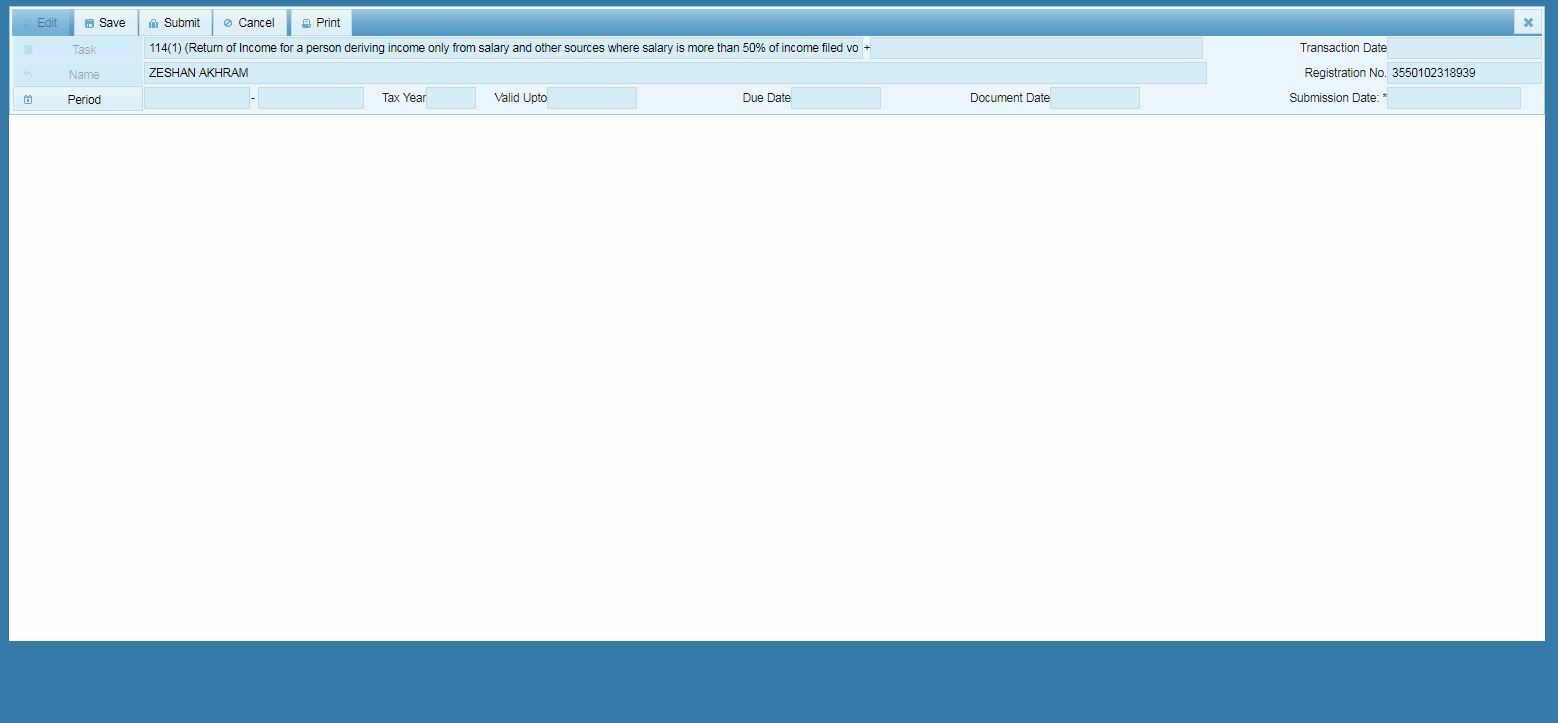

Step: 10 (Only for Government Employees Salary Persons) If you can’t not Govt. The employee then can’t fill it.

All Government Employees Salaried Persons can be filling this Form No. 114(1) Return of Income for Persons Deriving Income Only From Salary and Other Sources Where Salary is More Than 50% of Income after selection of the time period of their Goshwara.

Now final you can submit all the forms then fill them completely and get your NTN Number after making Filer in FBR for Income Tax Returns easily.

If you can feel any problem then contact me and I will make you filer in Rs. 1000/= Only Please Contact Us.

0308_4121499

For Help and Further Details.

How to Get NTN Number and FBR Filer Registration.